SHINKO ELECTRIC INDUSTRIES CO., LTD.

SHINKO ELECTRIC INDUSTRIES CO., LTD.

The Financial Stability Board (FSB) has established the Task Force on Climate-related Financial Disclosures (TCFD) to reduce the risk of instability related to climate change in financial markets. Responding to the TCFD recommendations in 2017, the Shinko Group has committed to making disclosures in line with the recommendations, and as SHINKO ELECTRIC INDUSTRIES CO., LTD., we expressed our support for the TCFD recommendations in May 2022.

The Shinko Group actively discloses information on climate change to investors and other stakeholders.

We have established the Environmental Committee chaired by the Representative Director of the Board, President, as a framework for promoting environmental management. The Committee deliberates on environmental issues, including policies, specific targets, and management systems (assessments, monitoring, and management of business risks and opportunities due to climate change). As well, the committee shares and manages progress on addressing climate change and other environmental issues. Those results are reported to the Board of Directors.

Further, as part of a company-wide risk management system, we have established the Risk Management Committee chaired by the Representative Director of the Board, President, to promote risk management throughout the entire Group. To fully understand and respond to risks that could impact our business operations, including climate change, we analyze and respond to risks Groupwide. The Board of Directors receives regular reports on the important risks that have been identified, analyzed, and evaluated.

In addition, the Shinko Group has established an environmental management system based on ISO 14001 certification, and the results of activities are reported to the Board of Directors.

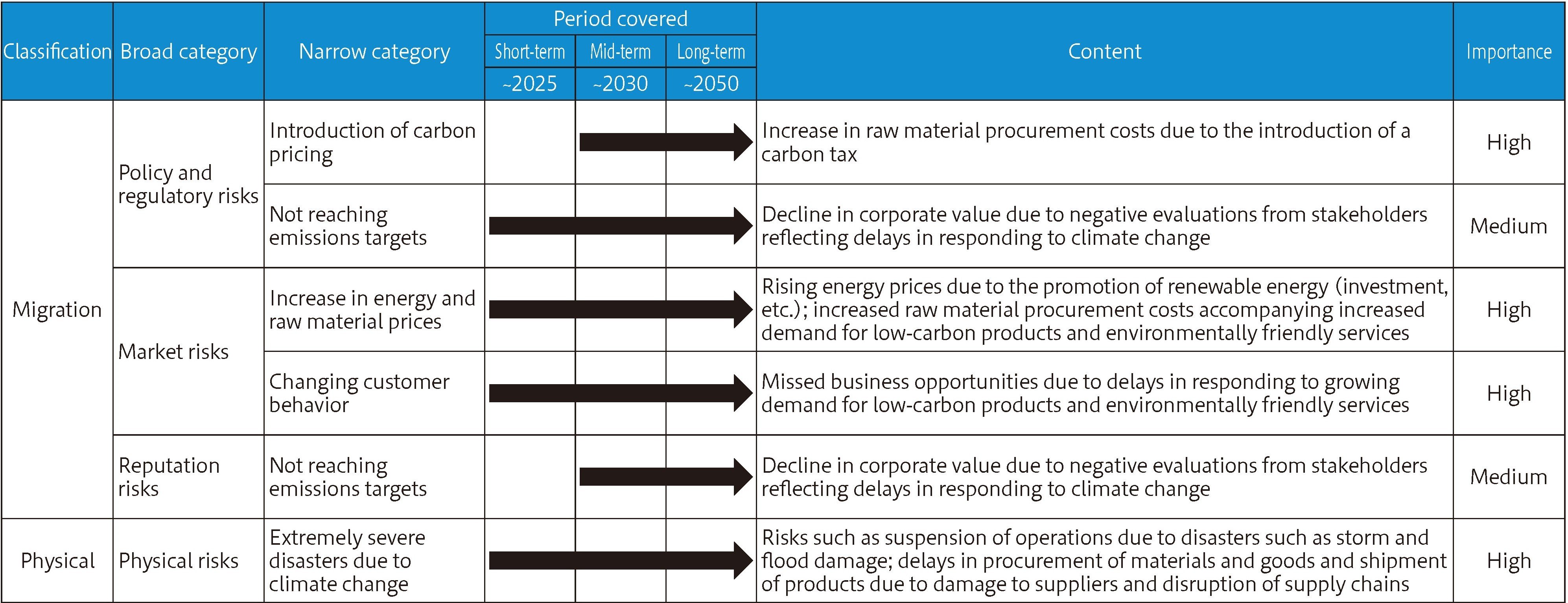

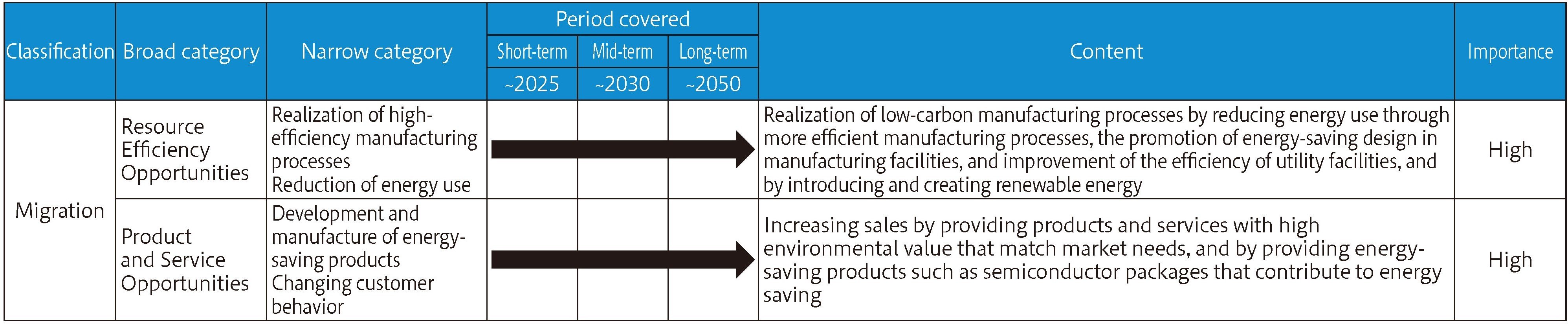

Evaluation of the Importance of Risks and Opportunities

To begin our scenario analysis, we identify the current and future climate change risks and opportunities facing our group and assess their importance based on the magnitude of their impact on our business.

【Evaluation of the Importance of Risks】

【Evaluation of the Importance of Opportunities】

Defining Scenario Groups

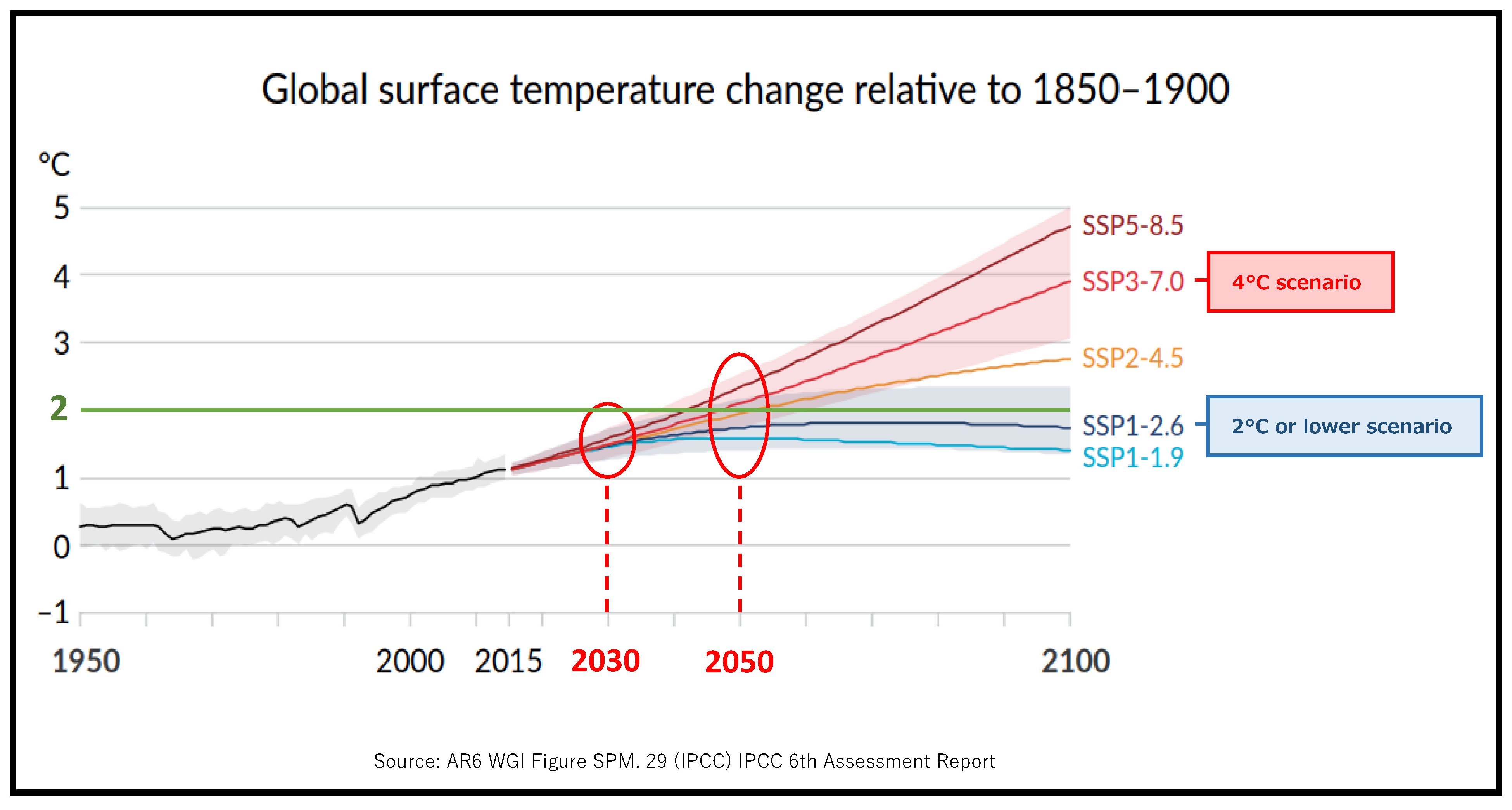

Based on the sixth assessment report released by the Intergovernmental Panel on Climate Change (IPCC), the Shinko Group has established a "2°C or lower scenario" and a "4°C scenario." The external information we refer to takes into account information from scenarios such as the International Energy Agency (IEA) STEPS (Stated Policies Scenario), APS (Announced Pledges Scenario), and NZE (Net Zero Emissions by 2050 Scenario) until 2050.

In the 2°C or lower scenario, we expect tighter regulations, such as the introduction of a carbon tax, and the risk of higher prices for electricity and raw materials like metal. We also expect opportunities in the form of increased sales of low-carbon, energy-saving products thanks to efficiency improvements in manufacturing facilities achieved by meeting the decarbonization needs of markets and customers, and stabilization of costs associated with the creation of renewable energy. In particular, in the 4°C scenario, it is assumed that physical risk due to increases in scale will be greater along with the frequency of high-wind and flood disasters as extreme weather events cause natural disasters to become more severe.

In order to realize these opportunities and respond to risks, we have formulated the "medium- to long-term environmental targets" and are working toward achieving carbon neutrality by reducing greenhouse gas emissions to net zero by 2050 to contribute to the realization of a decarbonized society and respond to climate change.

To fully understand and respond to risks that could affect the business operations of the Shinko Group, including climate change, we identify, assess, and manage risks across the Group. In regular company-wide risk assessments, every division and Group company conducts assessments on items such as the impact and likelihood of the occurrence of risks, the status of countermeasures, and to provide responses to risks. For the risks related to climate change, we use information collected from across the Group to assess policies, reputation, natural disasters, the supply chain, products and services, etc. The results of the assessments, answered by each division, are conducted using a centralized matrix analysis to investigate the possible impact and likelihood of occurrence, then high-priority risks are identified at the company-wide level. The results of these analyses are reported to the Board of Directors.

The Environmental Committee shares business risks, opportunities, and countermeasures related to climate change, and manages progress. In addition, the Shinko Group has established an environmental management system based on ISO 14001. Under this system, we monitor risks on compliance, etc.

As part of our efforts to adapt to climate change, we are strengthening our internal countermeasures to reflect the increasing severity and frequency of typhoons and floods caused by extreme weather events. Specifically, in addition to taking preliminary measures based on hazard maps and other information at each site, we are working to minimize damage by establishing a "Typhoon and Flood Damage Timeline" for each site and division that defines action criteria and outlines of actions to take in the event of a disaster, and by conducting training on an ongoing basis.

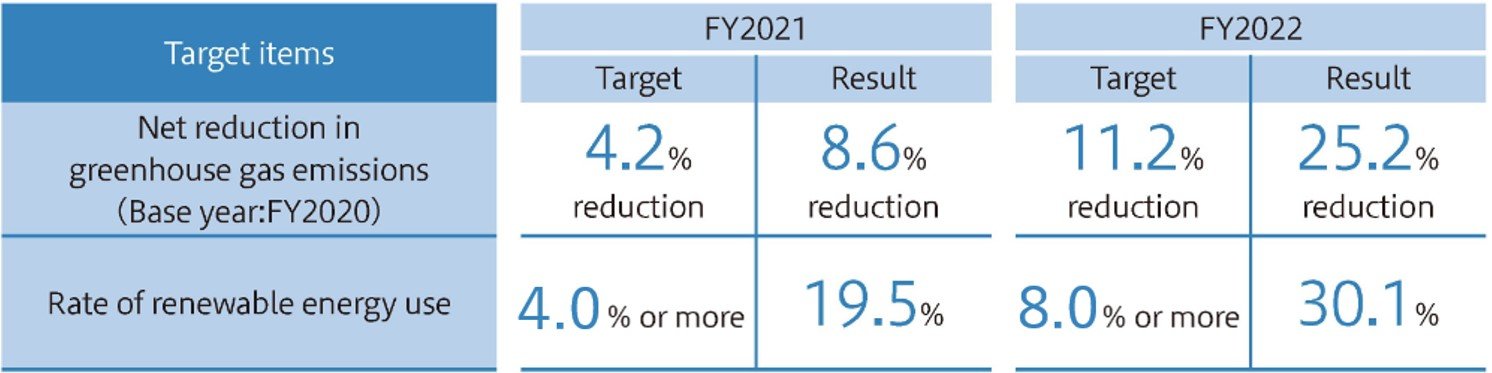

The Shinko Group, recognizing the importance of reducing greenhouse gas emissions and adopting renewable energy for countering climate-related risks, uses greenhouse gas emissions and renewable energy adoption rates as key metrics. With regard to the reduction of net greenhouse gas emissions, we aim to achieve carbon neutrality with net-zero emissions by FY2050. Backcasting from that, we have established a target for FY2030 and are conducting activities to help us meet it. In the area of renewable energy utilization, we have set a target of 100% utilization by FY2030 and are working toward that target.

We have also set annual targets and are monitoring metrics to manage the progress of our strategy and associated risks.

Note: Boundary of the targets is Scope1 and Scope2 at all business sites in Japan.

【Medium- to Long-term Targets】

【Yearly Targets and Actual Results】